Auto Trading Strategy Explanation

Counter-trend swing trading strategy aims to capture market trend reversals for profit by accumulating minimum quantities and lowering average purchase price.

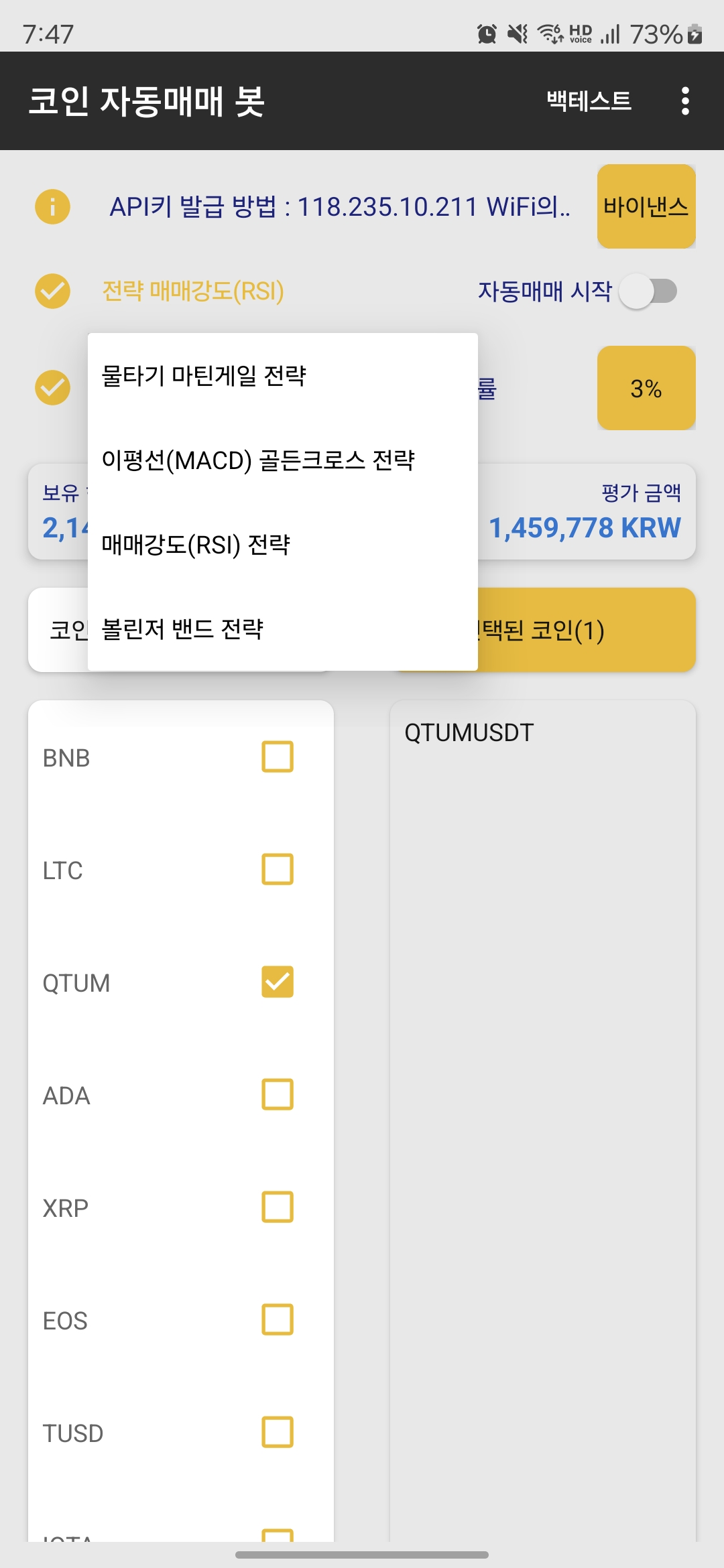

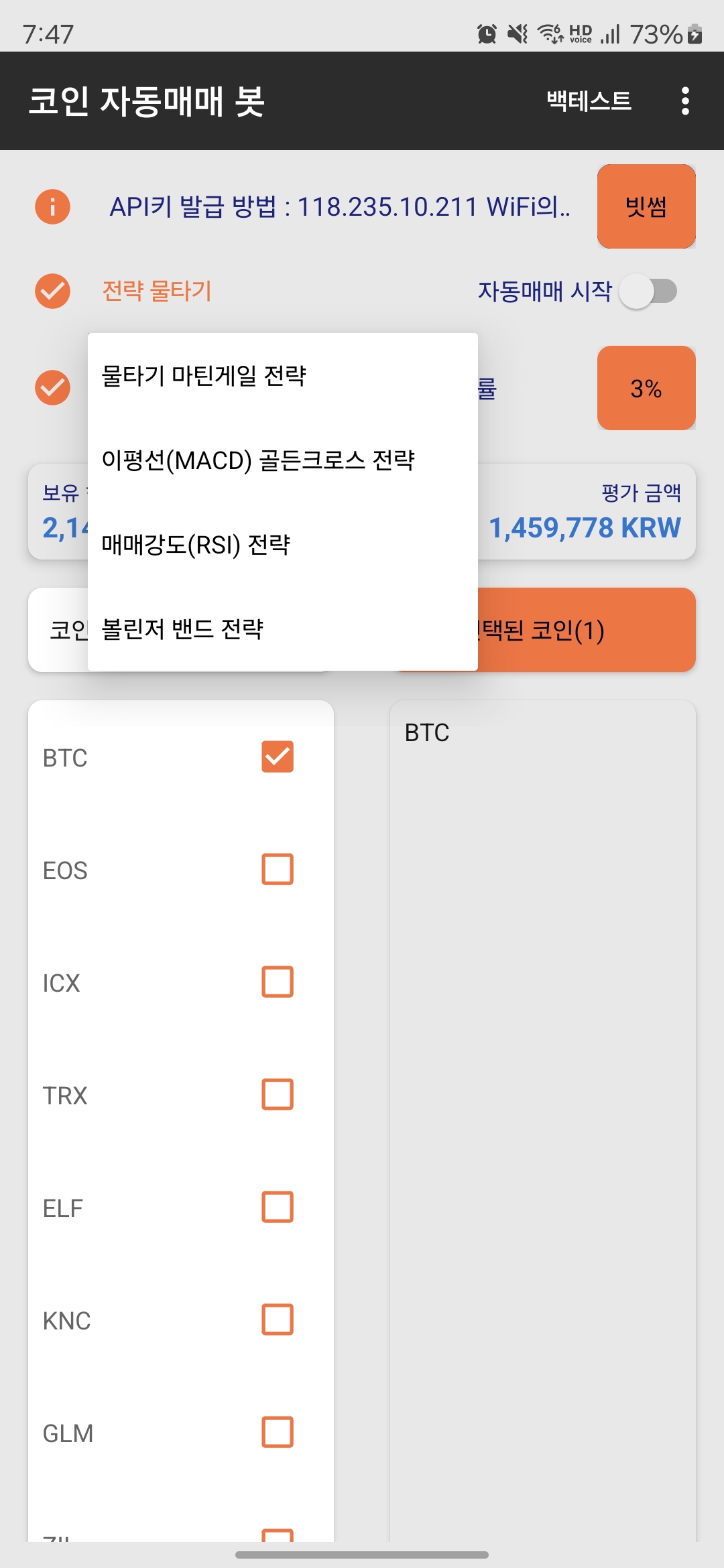

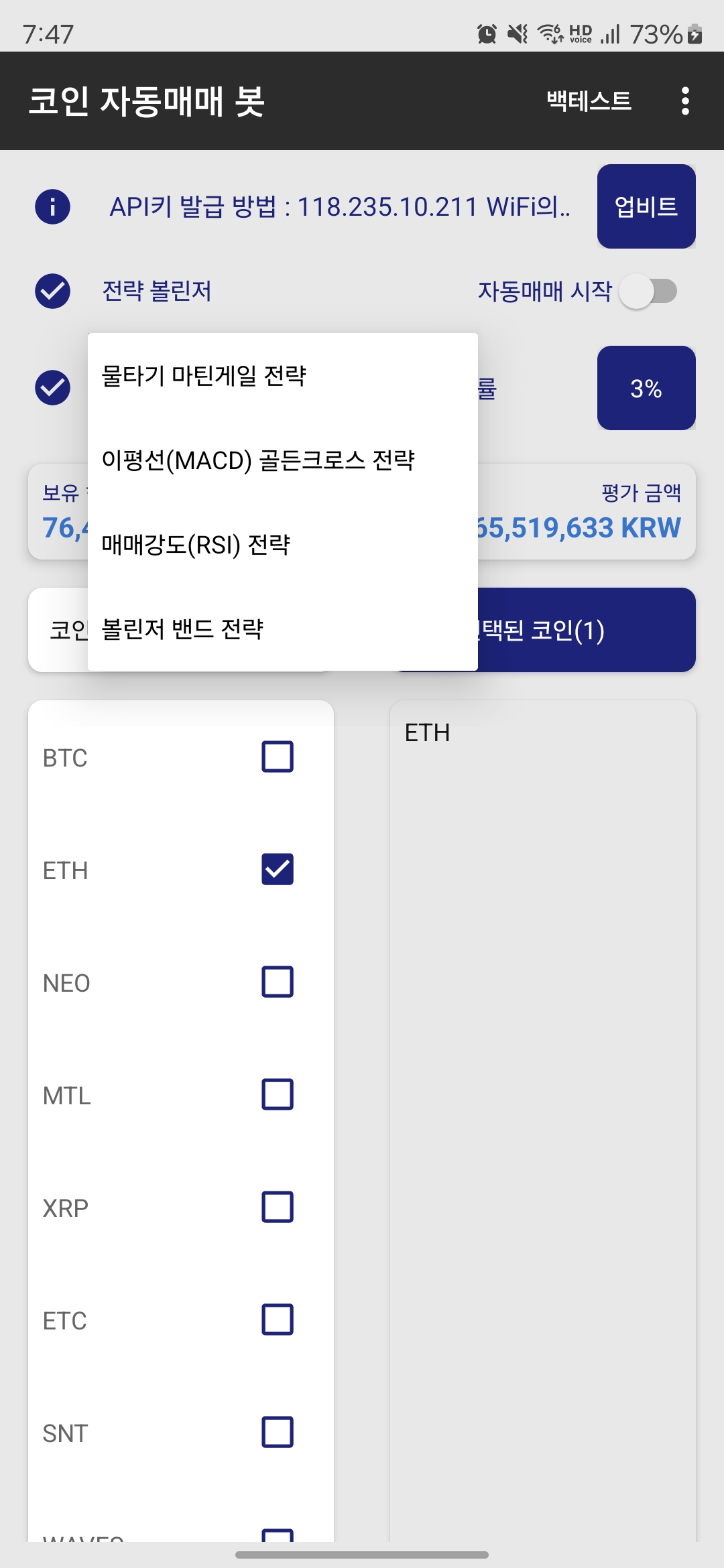

Automated Trading Strategy Explanation

This app supports the following 4 automated trading strategies.

- Martingale Strategy: After acquiring the minimum quantity, this strategy lowers the average purchase price and captures market trend reversal points to generate profits.

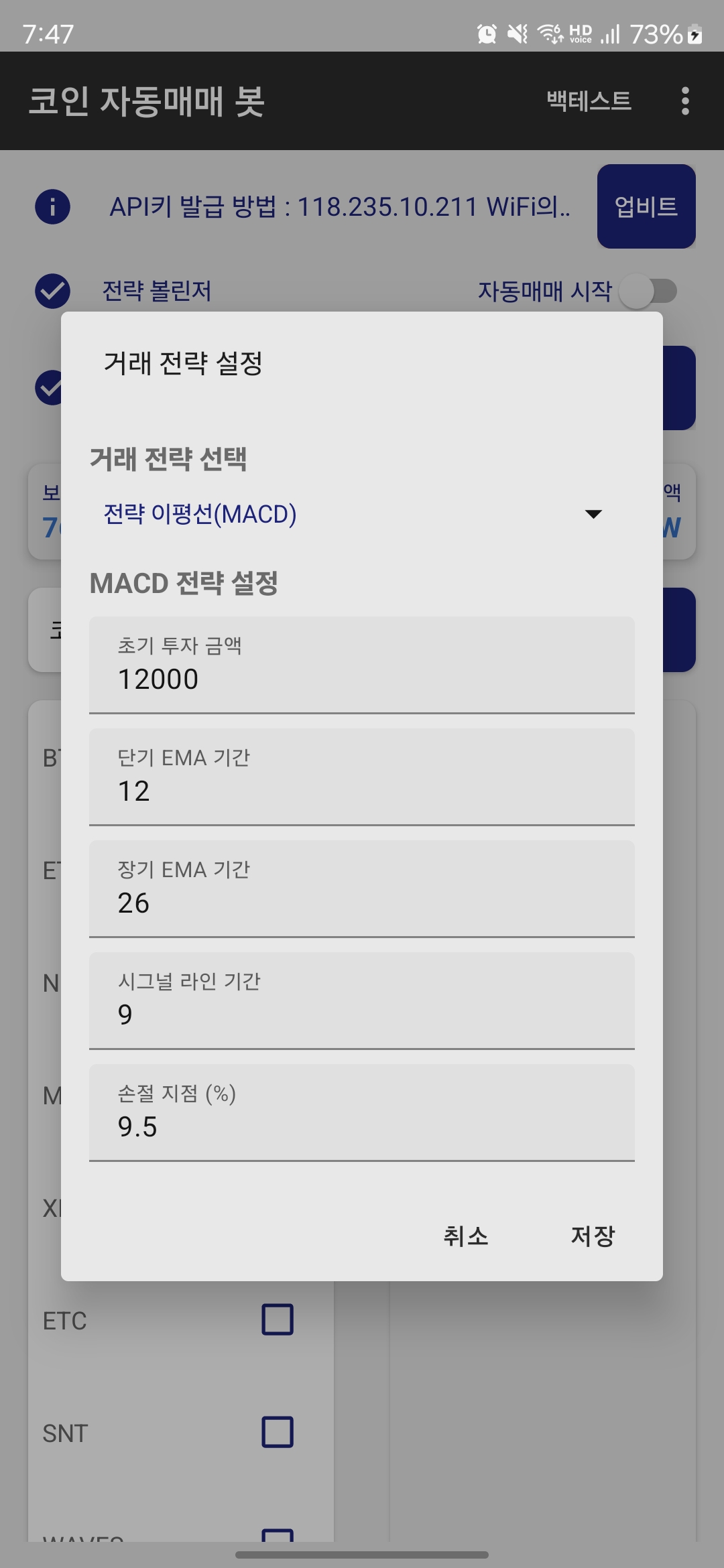

- MACD Strategy: Utilizes the convergence and divergence characteristics of moving averages with different periods

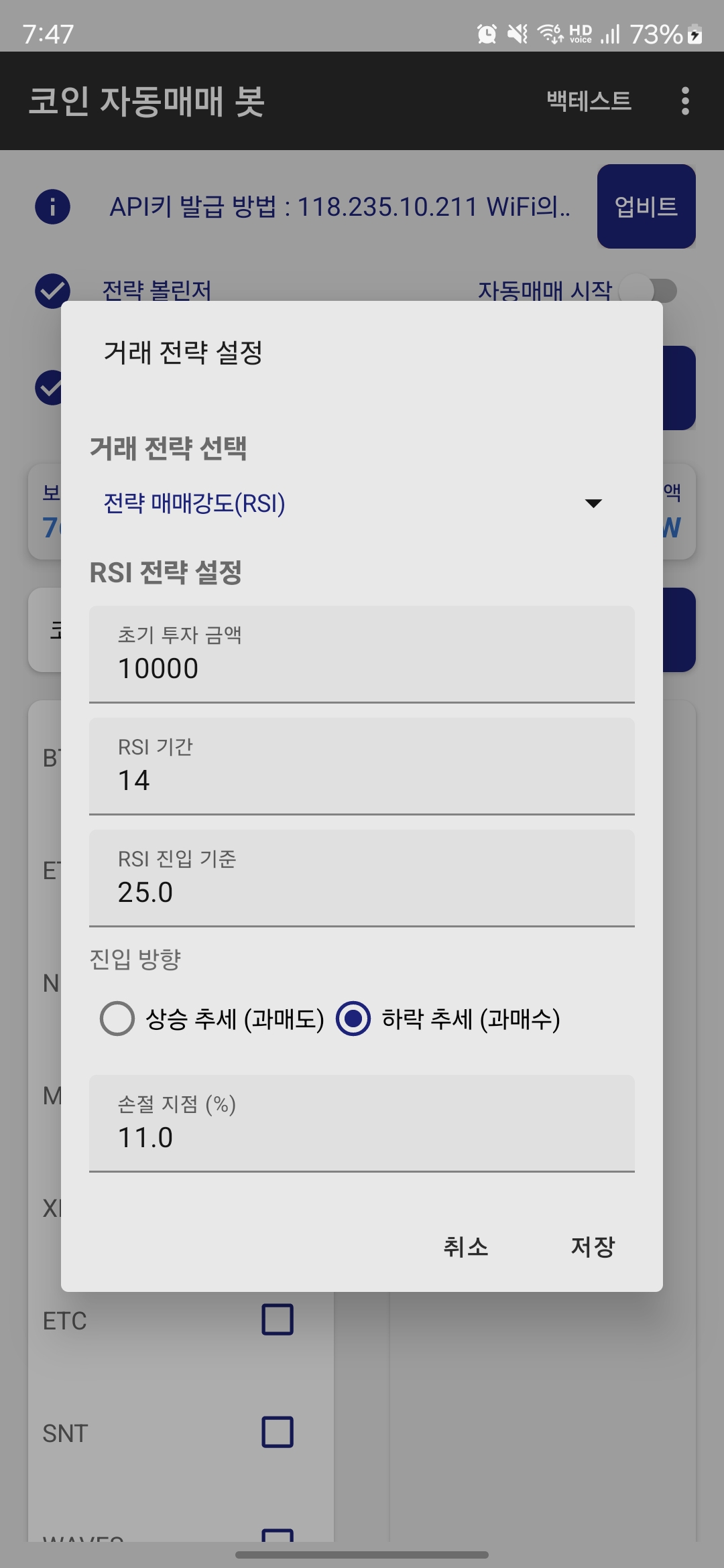

- RSI Strategy: Analyzes the strength of bullish and bearish candles to index buying and selling pressure

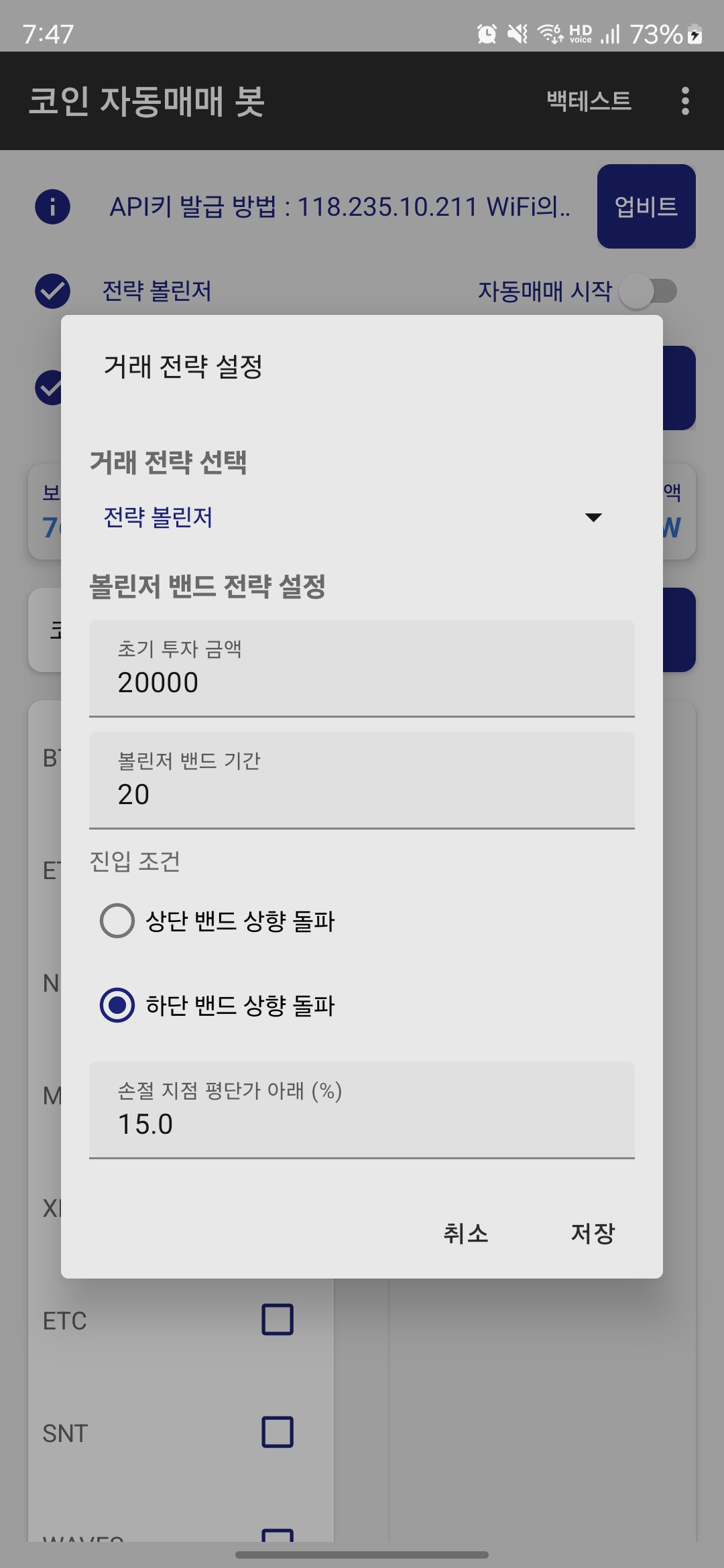

- BB Strategy: Sets upper and lower price movement bands and interprets breakouts as trading signals

1. Key Features

- Trend Capture: Identifies entry timing appropriate for each strategy.

- Position Building: Increases or liquidates positions according to averaging down, stop-loss, and take-profit settings.

- Fund Management: It is recommended to keep the initial entry amount low and maintain available cash reserves.

2. How to use

Check the official Upbit/Bithumb/Binance apps for actual trading history.

3. Advantages

- Enjoyment of monitoring system trading

- Reduced manual trading fatigue

4. Disadvantages

- Conflicts between manual trading and system trading logic

- Risk of loss when cash is insufficient

⚠️ Caution: Recommended cash reserve of 2 million KRW per selected coin.

5. Usage Guidelines

Stable Connection Required

This auto trading program runs on your device and requires stable fixed IP connection (VPN or ISP fixed IP). Please note that API trades may fail if your home WiFi IP changes occasionally.

Daily Check Recommended

Check daily if the program is operating normally, and it’s good to monitor reserved trade status through official Upbit and Bithumb apps simultaneously.

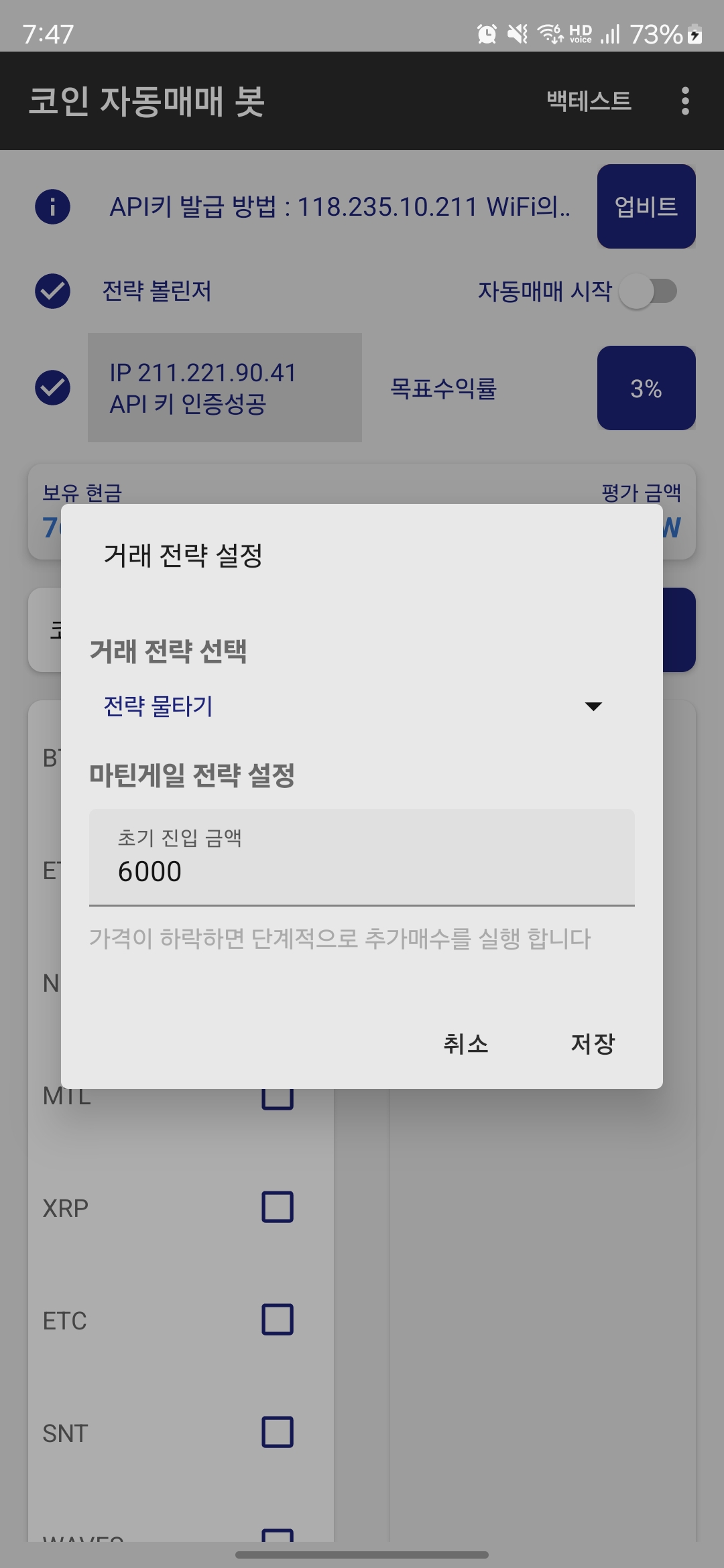

6. From Martingale to 3 more Trend Following Strategies!!

1. MACD (Moving Average Convergence Divergence)

- Core Principle: Utilizes the characteristic pattern of moving averages with different periods converging and diverging

- Entry Points: Captured through crossover points of two lines

- Signal Interpretation: Golden cross (histogram transitioning from negative to positive) interpreted as bullish signal

2. RSI (Relative Strength Index)

- Core Principle: Quantifies buying and selling pressure by analyzing the strength of up and down candles

- Strategic Choice:

90% of cases: Mean reversion occurs10% of cases: Trend continues, offering significant profit opportunities- Important: Stop-loss lines are essential as this is directional trading

3. Bollinger Bands

- Core Principle: Sets upper and lower bounds for price movements, interpreting breaks as trading signals

- Practical Experience:

90%: Price returns inside after touching the bands10%: Price breaks through bands and forms strong trends- Essential: Strict stop-loss management required

4. Actual Implementation Results

|  |

|---|---|

|  |

|  |

|  |

5. Key Insights from Implementation

Signal Scarcity: Strong trend signals occur only a few times per year.

- Value of Patience: While it may seem boring, waiting itself is a crucial element of investing

- High Success Probability: Signals captured after long waits tend to have higher success rates

- Stay Humble: Nothing is certain in the markets, so maintaining humility is essential

6. Distinctive Features of Our Program

Whipsaw Risk Minimization Strategy:

- Adopted time-frame based trading logic instead of real-time execution

- Hourly market checks to respond to sudden price movements

- Stability-focused design to prevent unnecessary stop-losses

💭 The Essence of Trend Following = The Art of Waiting

Understand that signals don’t occur daily and approach with patience.

Now, let’s begin your successful investment journey with these new strategies!

7. Maringale

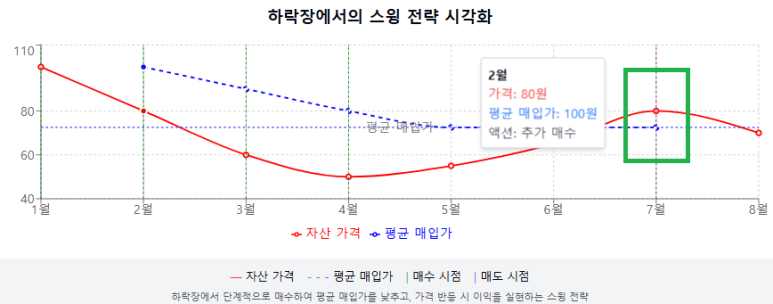

While most investors hope for bull markets, some traders can profit during bear markets as well. These traders generally fall into two categories: those who take short positions in the futures market and those who employ swing trading strategies in the spot market.

Futures Market Short Positions: A Strategy for Expected Price Declines

A short position in the futures market is a strategy utilized when anticipating price decreases. Here’s a simple example:

A potato seller expects potato prices to decline in the future

They enter into a contract to supply potatoes in 3 months at the current price of 100 won

If after 3 months the actual potato price drops to 50 won, the seller purchases potatoes from the market at 50 won and supplies them to the buyer at the contracted price of 100 won, earning a profit of 50 won

This strategy allows traders to realize profits solely from price declines.

Spot Market Swing Trading: Betting on Rebounds After Declines

Swing trading involves holding assets while taking advantage of price fluctuations:

In a declining market, gradually purchase assets to lower your average buying price

Example: If you buy at 100 won, 80 won, 60 won, and 50 won, your average purchase price is about 70 won

When the price rebounds to 80 won, you can sell for a profit of 10 won

This strategy is essentially betting on the probability that prices will rise again at some point

Advantages and Disadvantages of Swing Trading

Advantages:

A systematic buying strategy can lower your average purchase price

You can generate profits by capitalizing on price volatility

It helps develop good cash management habits

Disadvantages:

You need to maintain sufficient cash reserves for additional purchases

There’s a risk that prices may continue to decline without rebounding

Similar to how Warren Buffett doesn’t invest all his assets at once and maintains cash reserves, this swing trading strategy can help develop disciplined cash management habits.

Results Display

Below are the results of an automated swing trading strategy.

These are hourly and daily charts from the past week. The strategy buys during downtrends and sells during rebounds.

|  |

|---|