Why Do We Perform Backtesting? It’s to Achieve Successful Investment by Understanding High Returns and Low Risk (MDD)

All investors seek high returns. However, if you only chase high returns, you may be shocked by unexpected losses or quit investing altogether.

Therefore, by checking your target returns and corresponding MDD before investing, you can determine whether the potential losses are within your acceptable range and if the investment is suitable.

For example, between two strategies that both yield 50% returns - one with an MDD of -90% and another with an MDD of -30% - the latter is clearly the better strategy.

This is why we perform backtesting.

So What is MDD (Maximum Drawdown)?

MDD represents the ‘maximum loss potential’ that can occur during the investment process. In simple terms, it’s an indicator that shows “how much your money could decrease” during investment.

Let’s look at a simple example:

- Starting with ₩10,000,000:

- ₩2,000,000 loss → MDD -20%

- ₩5,000,000 loss → MDD -50%

- ₩9,000,000 loss → MDD -90%

In other words, MDD is an important indicator that tells us in advance how much our investment could decrease in the worst case. This helps us imagine the psychological impact when ₩10 million becomes ₩8 million versus when it becomes ₩1 million.

Conditions for a Good Investment Strategy - Low Risk (MDD)

- Low MDD: Ability to avoid large losses, something that can be found through learning and effort via backtesting

- How to find it? Let’s adjust the parameters below.

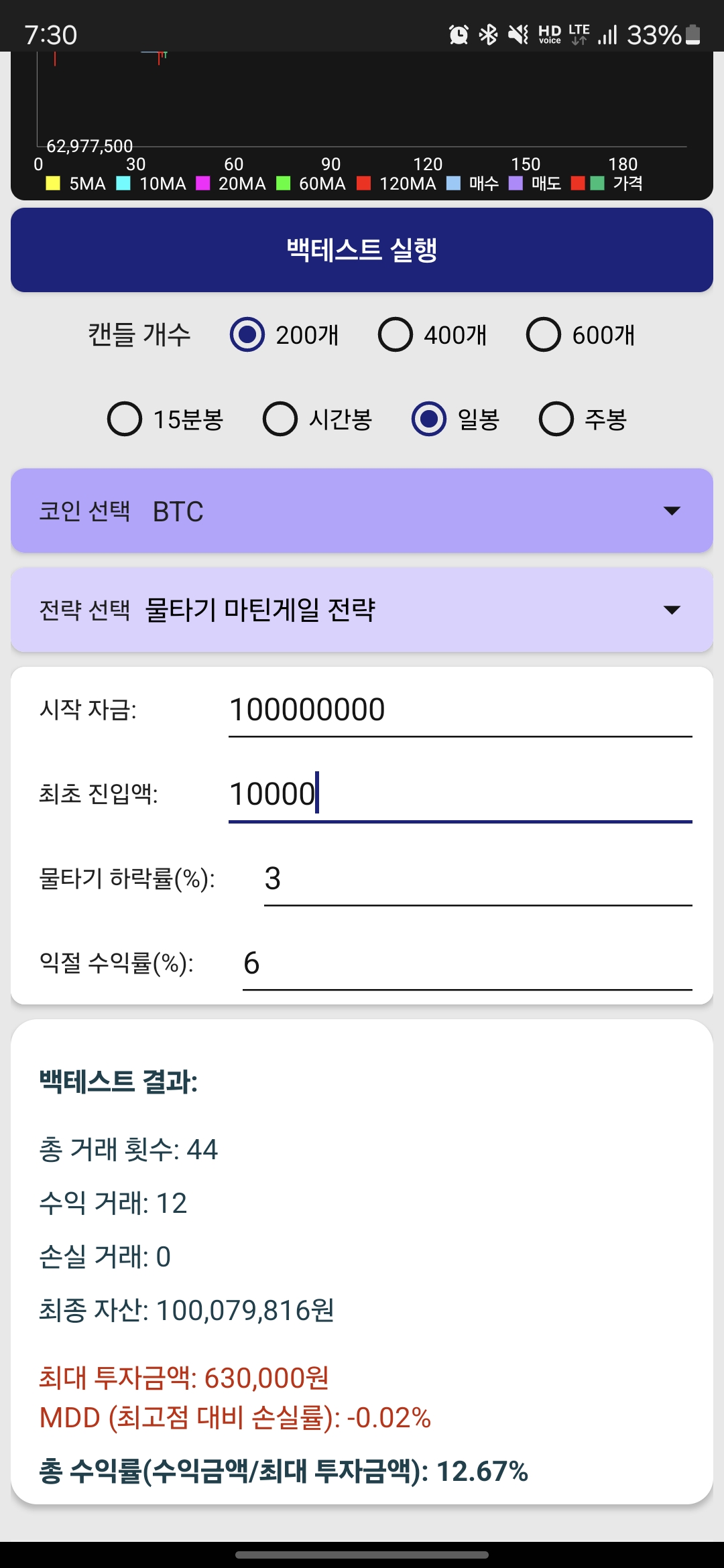

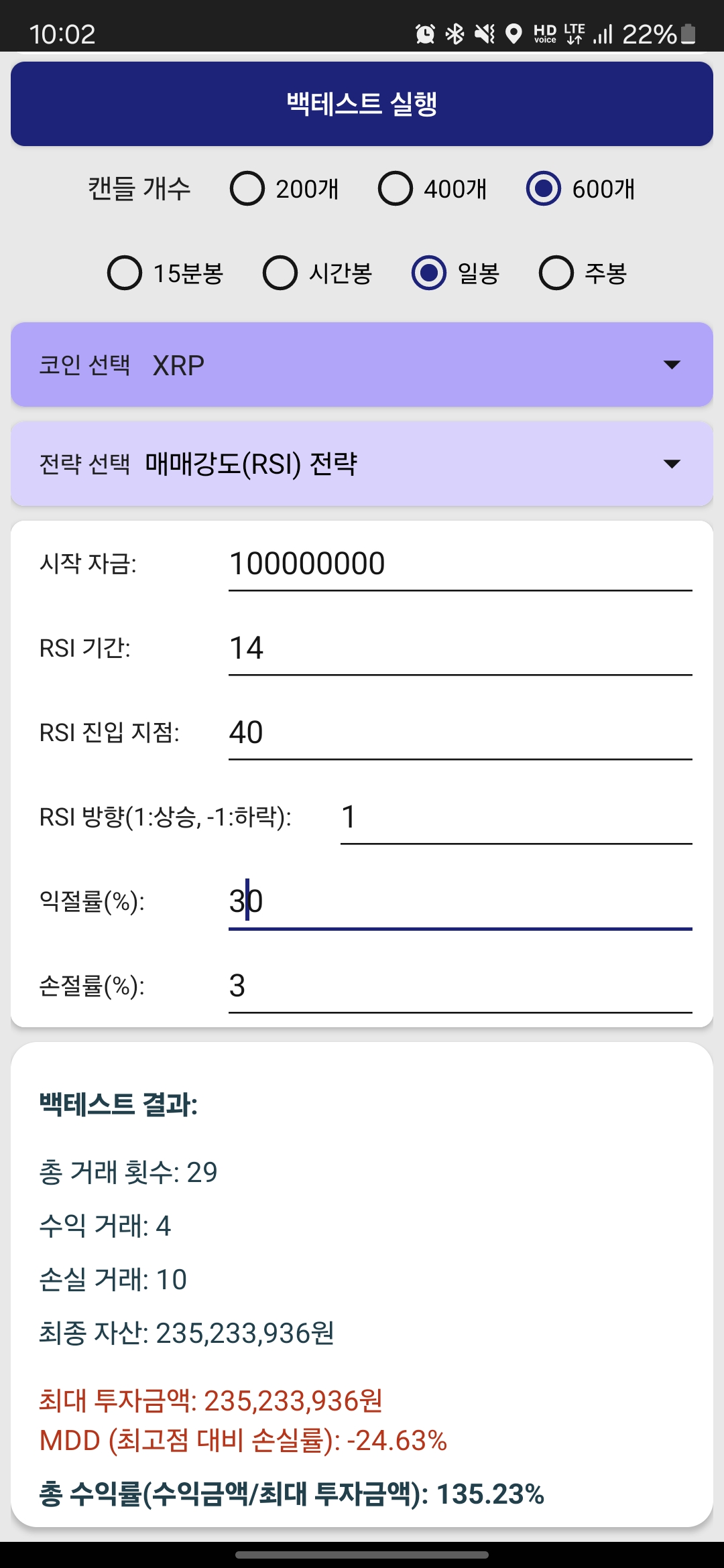

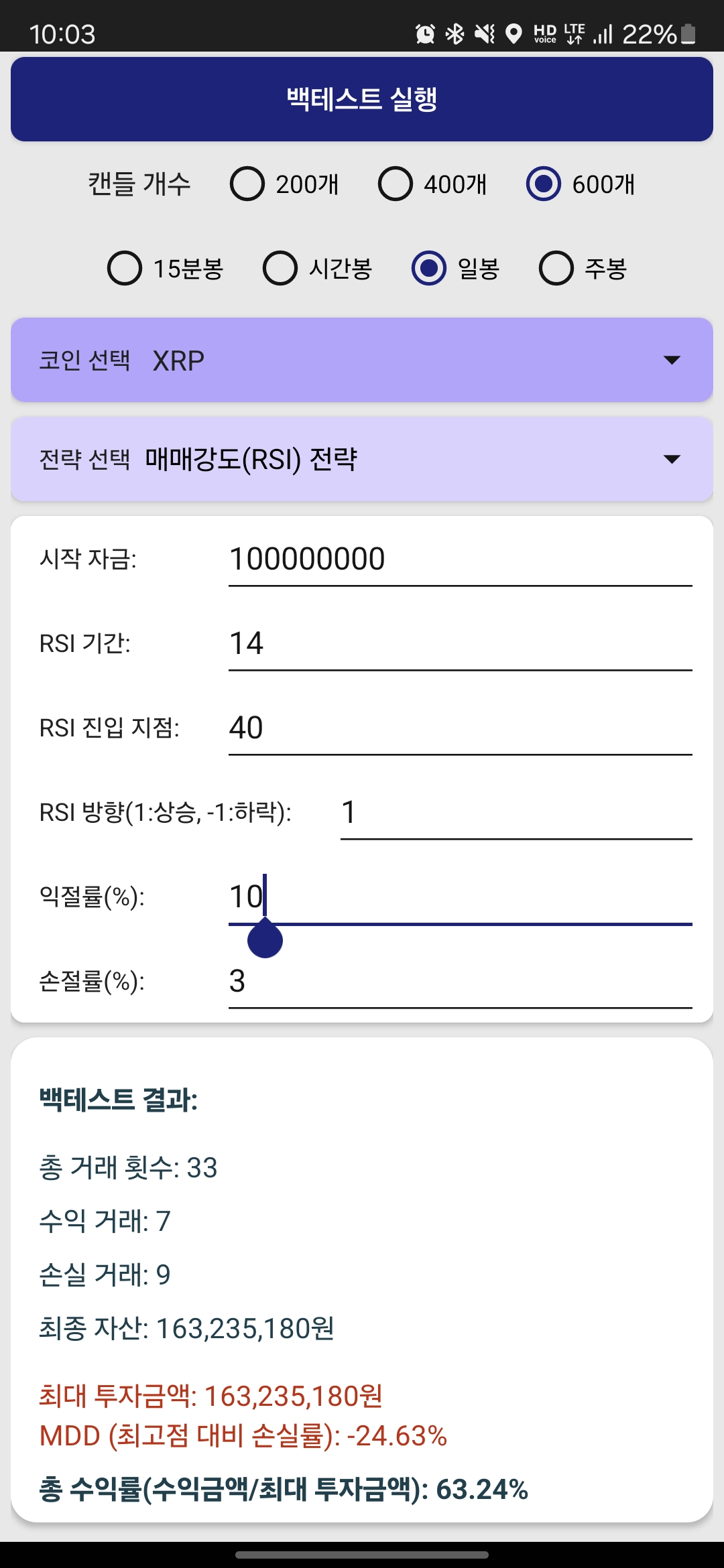

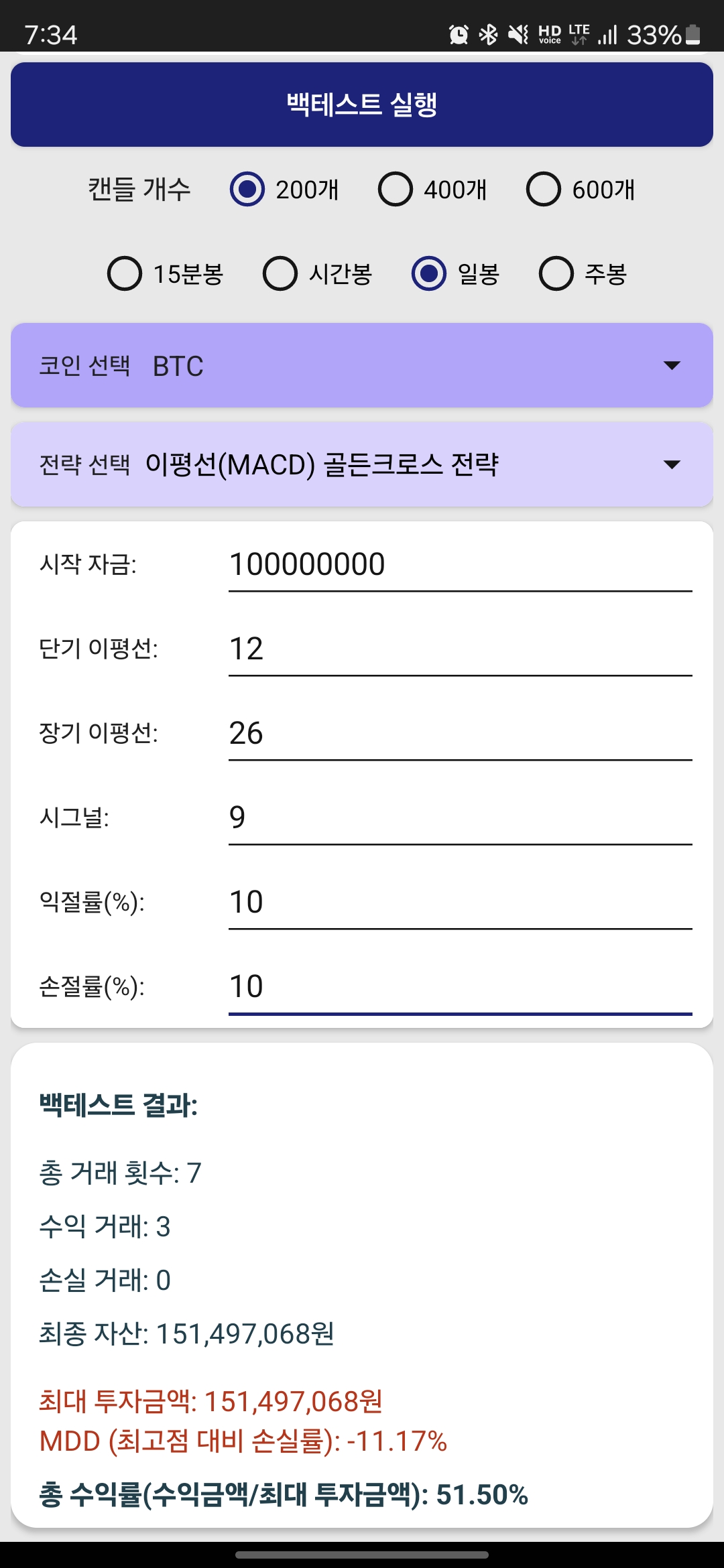

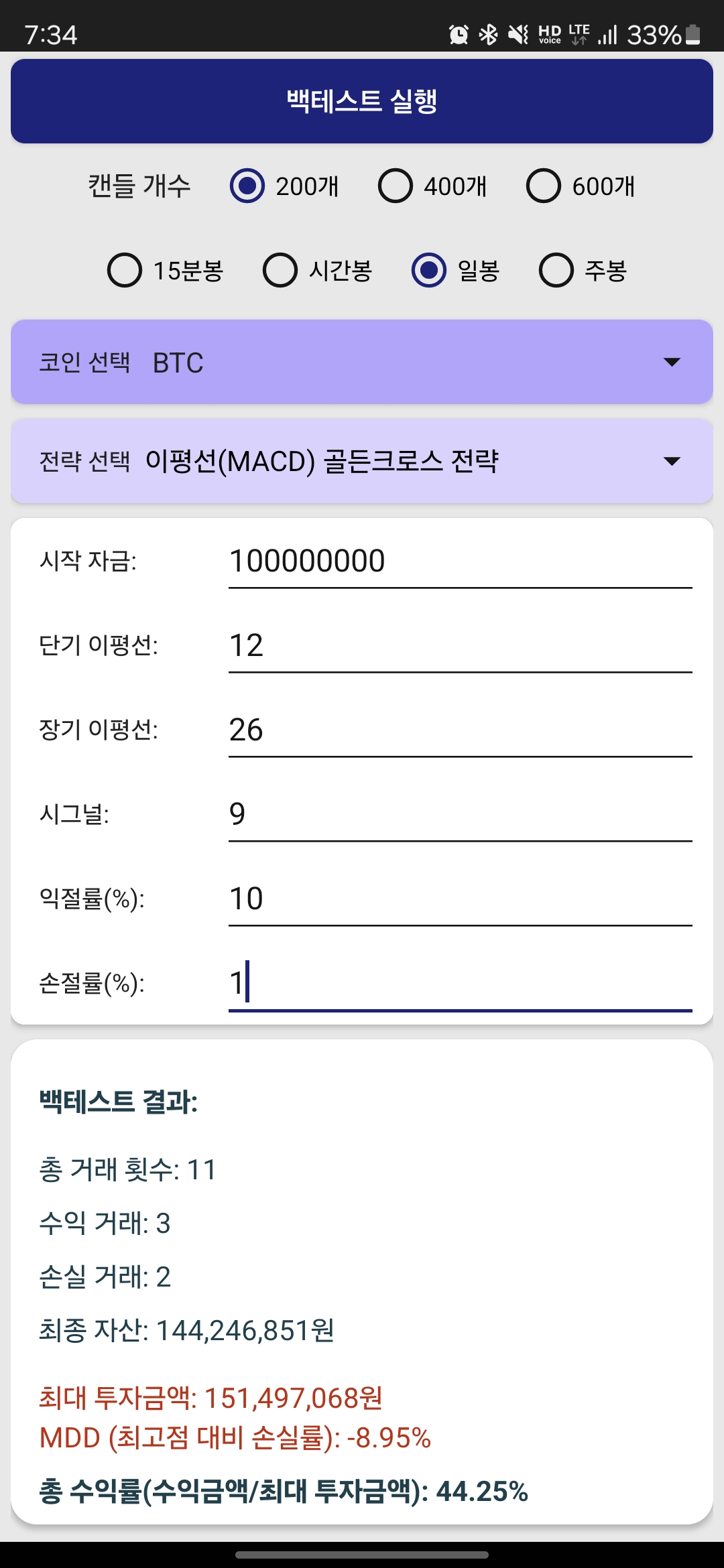

Comparing Backtest Results

Here are examples of backtesting based on the above concepts. You can observe the action and reaction when values are increased or decreased.

- High Seed: Profits increase, but losses also increase

- Low Seed: Profits are small, but losses are also small

- High Take Profit Value: The goal is to make large profits, but there's a higher chance of hitting stop loss before reaching the target

- Frequent Take Profit: Satisfies with small profits and frequently realizes gains. Win rate increases but loses opportunities for large profits

- Low Stop Loss Value: Prevents large losses through early exits, but also misses potential rebound opportunities

- Few Stop Losses: Sets wider stop loss range, lowering stop loss criteria. Results in larger losses when triggered due to lower exit points

Differences Based on Investment Amount (Seed)

- Large Purchase Amount: Large profits possible, but MDD also increases. Cash can be depleted quickly

- Small Purchase Amount: Small profits but low MDD. Allows reinvestment with remaining cash during downturns. As someone who values stability, I prefer this strategy

|  |

|---|---|

| Large Purchase Amount | Small Purchase Amount |

Impact on Returns: Risk-Reward Ratio and Win Rate

- High Take Profit captures large gains at once. However, the probability of stop loss increases. Aggressive investors prefer this strategy

- Low Take Profit realizes frequent gains. This means good win rate. However, it can’t generate large profits. Conservative investors prefer this strategy

|  |

|---|---|

| High Take Profit Setting | Low Take Profit Setting |

Impact of Stop Loss: Risk-Reward Ratio and Win Rate

- High Stop Loss value may reduce the frequency of stop losses. It doesn’t lock in losses, but when stop loss triggers, you must bear a large loss

- Low Stop Loss value can limit loss amounts, but frequent stop losses can cause psychological pressure due to their frequency

|  |

|---|---|

| High Stop Loss Setting | Low Stop Loss Setting |

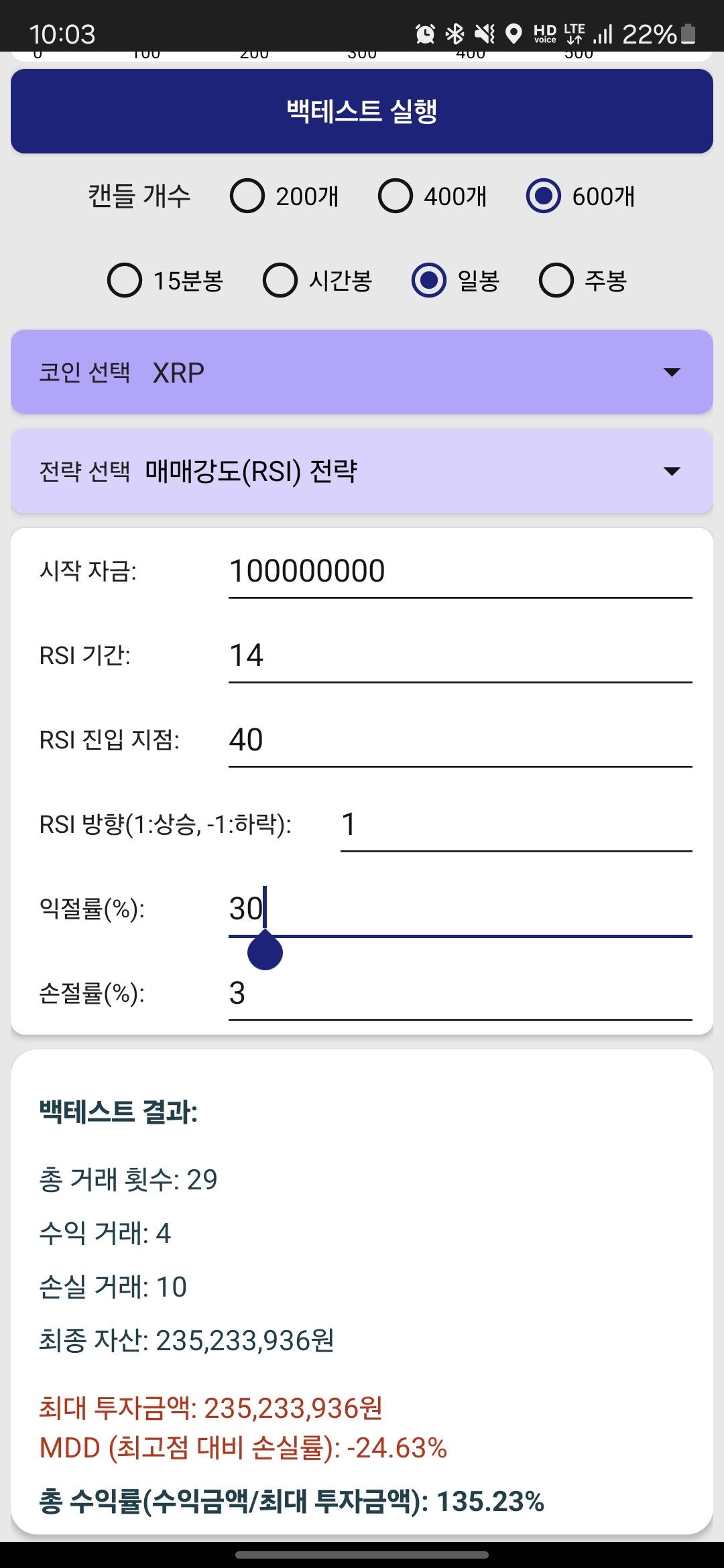

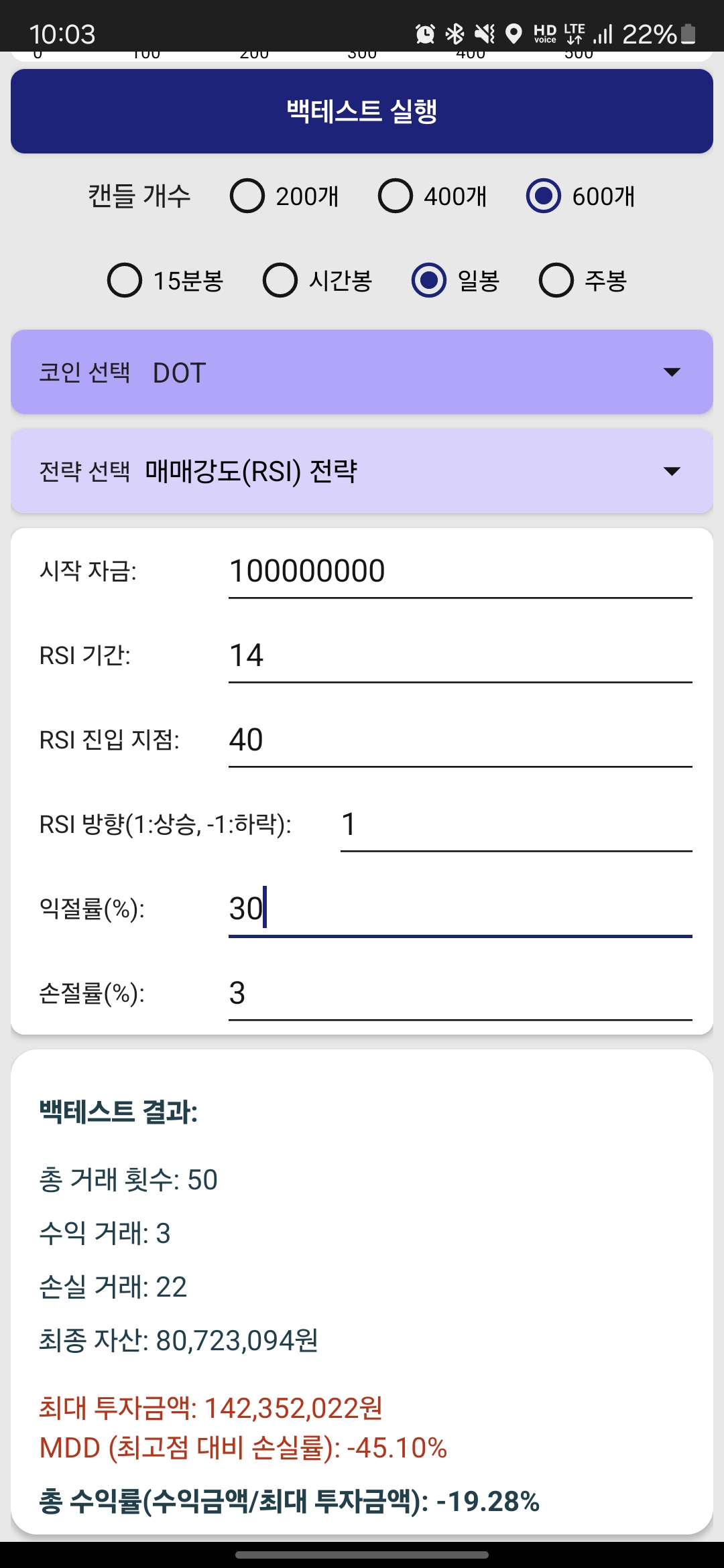

Differences Based on Market Conditions

- Even the best strategy can’t beat the market. The purpose of backtesting is to verify strategies considering worst-case market scenarios

- As you can see below, the same strategy shows different results in different markets. Therefore, we must accept that there’s no absolute strategy

- That’s why we might shout “eureka” when finding a good strategy, but eventually realize that’s not the case. This is why we must remain humble before the market

|  |

|---|---|

| Bull Market | Bear Market |

Conclusion

I’ve explained about backtesting and MDD for finding investment principles that suit you. I believe these three things are important in all investments:

- Understanding your acceptable MDD risk level

- Analyzing risk-reward ratio and win rate based on take profit and stop loss strategies

- Finding investment principles that suit you after thorough backtesting

For successful investing, please verify your acceptable MDD through backtesting and establish investment principles that suit you. This is also why I developed this app. I hope everyone achieves successful investments by letting go of impatience and maintaining a long-term perspective.